Understanding your net worth is the cornerstone of effective saving and achieving your financial goals. Many individuals underestimate the importance of regularly calculating their net worth, which is simply the difference between your assets (what you own) and your liabilities (what you owe). Knowing this crucial number provides a clear picture of your current financial health, allowing you to make informed decisions about your savings strategy and future investments. This knowledge empowers you to track your progress, identify areas for improvement, and ultimately, build a more secure financial future.

The impact of knowing your net worth on your saving habits is profound. It provides a quantifiable measure of your financial success, motivating you to make smarter saving choices. Whether you’re aiming to buy a home, pay off debt, or plan for retirement, a clear understanding of your net worth allows you to tailor your savings plan to your specific financial aspirations. This data-driven approach helps you stay focused, adjust your strategies as needed, and ultimately, accelerate your journey towards financial independence. Ignoring your net worth is akin to navigating without a map—knowing it provides clarity, direction, and control over your financial destiny.

What Is Net Worth and How to Calculate It

Your net worth is a crucial financial figure representing your total assets minus your total liabilities. It’s a snapshot of your financial health at a specific point in time, showing the difference between what you own and what you owe.

Assets include everything of value you possess, such as cash, savings accounts, investments (stocks, bonds, mutual funds, retirement accounts), real estate, vehicles, and personal belongings. It’s important to include fair market value for these assets, which is what they would realistically sell for today, not necessarily what you paid for them.

Liabilities encompass all your outstanding debts. This includes mortgage loans, auto loans, student loans, credit card balances, personal loans, and any other outstanding bills.

Calculating your net worth is straightforward: Total Assets – Total Liabilities = Net Worth. For example, if you have $100,000 in assets and $50,000 in liabilities, your net worth is $50,000.

Regularly calculating your net worth provides a valuable benchmark to track your financial progress over time. It helps you to understand your financial standing and identify areas for improvement in your saving and spending habits. A positive net worth indicates you have more assets than liabilities, while a negative net worth shows the opposite.

It is recommended to perform this calculation at least annually, or even more frequently if you experience significant financial changes. Maintaining accurate records of your assets and liabilities will streamline this process.

Assets vs Liabilities: A Simple Breakdown

Understanding the difference between assets and liabilities is fundamental to grasping your net worth and, consequently, improving your savings strategies. Simply put, assets are things you own that have value, while liabilities represent what you owe.

Assets can be categorized into several types. Liquid assets are easily converted to cash, such as checking and savings accounts, and money market funds. Non-liquid assets take longer to convert to cash, including real estate, vehicles, and investments like stocks and bonds. The value of these assets can fluctuate.

Liabilities represent your debts and obligations. These include short-term liabilities like credit card balances and utility bills, and long-term liabilities such as mortgages, student loans, and auto loans. It’s crucial to track all your liabilities to accurately assess your financial position.

By clearly identifying your assets and liabilities, you can calculate your net worth – the difference between your total assets and total liabilities. A positive net worth signifies you own more than you owe, while a negative net worth indicates the opposite. This calculation provides a critical snapshot of your financial health and guides your savings goals.

Knowing your net worth isn’t just about numbers; it’s about understanding your financial standing and making informed decisions about saving and spending. This knowledge informs better financial planning and helps you make strategic choices to improve your financial future.

Why It’s More Important Than Income Alone

While your income is undoubtedly a crucial factor in your financial well-being, focusing solely on it provides an incomplete picture of your overall financial health. Net worth, on the other hand, offers a more comprehensive understanding of your financial situation by considering both your assets and your liabilities.

Understanding your net worth allows you to see the big picture of your financial standing. It highlights the true value of your accumulated wealth, showing not just how much money you earn, but how much you’ve managed to accumulate and own after accounting for your debts. This provides a much clearer picture of your financial progress than income alone can.

Income is a flow; it’s the money you receive regularly. Net worth is a snapshot; it’s a measure of your wealth at a specific point in time. High income doesn’t automatically translate into high net worth. Someone with a high income but significant debt might have a lower net worth than someone with a more modest income but significantly less debt and substantial assets.

Knowing your net worth allows for more strategic saving. By understanding your assets and liabilities, you can identify areas where you can improve your financial position, such as reducing debt or increasing investments. This holistic view facilitates more effective financial planning and goal setting, leading to a more secure financial future.

Ultimately, focusing on building net worth is a longer-term strategy. While income is essential for living expenses, net worth represents the accumulation of your wealth over time. It signifies your progress toward financial independence and security, providing a more accurate reflection of your true financial health than income alone.

How Tracking Net Worth Affects Motivation

Tracking your net worth can be a powerful motivator for saving and investing. Seeing a tangible increase in your net worth, even a small one, can provide a significant psychological boost and reinforce positive financial behaviors.

This positive feedback loop is crucial. When you regularly monitor your net worth and see progress, it strengthens your commitment to your financial goals. It provides concrete evidence that your efforts are paying off, fostering a sense of accomplishment and encouraging you to continue on your path towards financial security.

Conversely, witnessing a decrease in your net worth can act as a wake-up call. It highlights areas where adjustments to spending habits or investment strategies might be necessary. This awareness, while potentially uncomfortable, can be a catalyst for more disciplined financial management.

The act of tracking itself also plays a significant role. The process of calculating and reviewing your net worth forces you to confront your financial reality. This increased awareness can lead to more mindful spending and a greater focus on long-term financial planning. You become more cognizant of your assets and liabilities, leading to more informed financial decisions.

Ultimately, the motivational impact of tracking net worth is deeply personal. For some, it provides the necessary accountability to stay on track; for others, it serves as a visual representation of their progress and a source of inspiration to continue striving toward their financial goals. The key is to find a system that works for you and to use the information gained to inform your financial decisions.

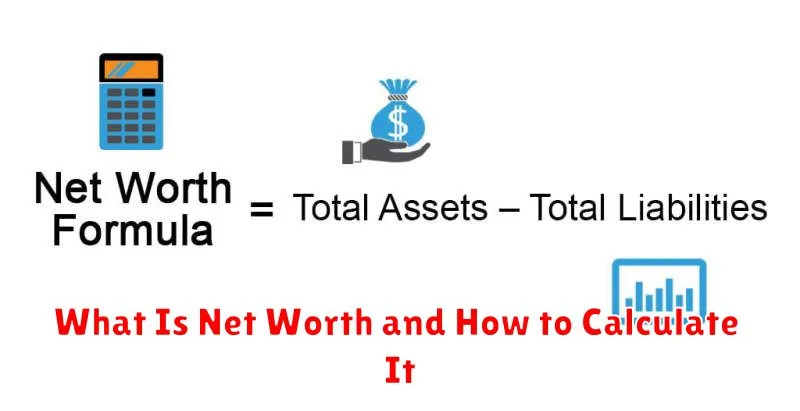

Use Free Tools or Spreadsheets for Clarity

Calculating your net worth can feel daunting, but it doesn’t require expensive software. Free online tools and even simple spreadsheets can provide the clarity you need. Many budgeting apps offer net worth tracking features as part of their broader services, often for free, providing a user-friendly interface.

Alternatively, a spreadsheet is a remarkably effective tool. You can easily create columns for your assets (e.g., checking accounts, savings accounts, investments, real estate) and your liabilities (e.g., credit card debt, loans, mortgages). Simply input the current value of each item, and the spreadsheet will automatically calculate your net worth. This method offers great control and customization; you can easily add or remove categories as your financial situation evolves.

The key is consistency. Regardless of the tool you choose, make a commitment to updating your net worth regularly, ideally monthly or quarterly. This allows you to track your progress, identify trends, and make informed decisions about your savings strategy. Consistent monitoring makes your financial picture much clearer and facilitates more effective saving.

Remember that the process of calculating your net worth is as important as the final number itself. The act of organizing your finances provides a valuable perspective that can guide your saving goals and overall financial health. Don’t let the perceived complexity deter you; the available free resources make it surprisingly simple to gain this crucial insight.

Review and Update Monthly or Quarterly

Regularly reviewing and updating your net worth is crucial for effective saving. A monthly or quarterly review allows you to track your progress and identify areas needing adjustment. This frequency provides a balance between detailed monitoring and avoiding unnecessary time commitment.

A monthly review offers a granular view, allowing for immediate adjustments to spending habits if necessary. You’ll catch any unexpected expenses or deviations from your financial goals quickly. This proactive approach prevents small issues from snowballing into larger financial problems.

Quarterly reviews provide a more macro perspective. They allow you to assess progress toward larger financial objectives, such as saving for a down payment or retirement. This timeframe is suitable for individuals who prefer less frequent but more comprehensive evaluations.

Regardless of your chosen frequency, consistency is key. Scheduling dedicated time for this task, perhaps tying it to existing monthly or quarterly bill payments, helps maintain a routine. Using a spreadsheet or a personal finance app can streamline the process and make tracking your net worth a manageable task.

Remember, the goal is to gain a clear understanding of your financial health. This ongoing process allows you to adapt your saving strategies based on real-time data and ensures that you stay on track towards your financial aspirations.