Are you struggling to save money? Do you feel like your financial goals are constantly out of reach? Many people find it challenging to consistently save, even small amounts. This article explores effective micro-saving strategies designed to help you build a strong savings habit, even with a limited income. We’ll delve into practical techniques that can significantly impact your financial future, allowing you to accumulate savings steadily and achieve your financial aspirations.

These micro-saving tips aren’t about drastic lifestyle changes; instead, they focus on incorporating small, manageable adjustments into your daily routine. We’ll uncover the power of consistent saving, highlighting methods such as rounding up purchases, leveraging spare change, and automating your savings. Discover how these seemingly insignificant actions can collectively contribute to a substantial increase in your savings over time. Learn how to effectively manage your personal finance and build a more secure financial life with our proven micro-saving strategies.

What Is Micro-Saving and Why It Matters

Micro-saving refers to the practice of saving small amounts of money regularly. This contrasts with traditional saving methods that often require larger, lump-sum deposits. Instead of focusing on large, infrequent deposits, micro-saving emphasizes the power of consistent, smaller contributions.

The significance of micro-saving lies in its accessibility and its ability to cultivate a saving habit. It’s particularly beneficial for individuals with limited income or those who are just beginning their saving journey. Even seemingly insignificant amounts, when saved consistently, can accumulate into a substantial sum over time due to the power of compound interest.

Beyond the accumulation of funds, micro-saving offers several other crucial advantages. It helps build financial discipline, teaching individuals to prioritize saving and manage their finances effectively. This, in turn, can lead to reduced financial stress and improved overall financial well-being. Furthermore, having readily available savings can serve as a vital safety net, providing a buffer against unexpected expenses or emergencies.

The impact of micro-saving extends beyond individual finances. On a larger scale, widespread adoption of micro-saving practices can contribute to economic growth and stability within a community. Increased savings can fuel investment and entrepreneurship, creating opportunities for both individuals and the broader economy.

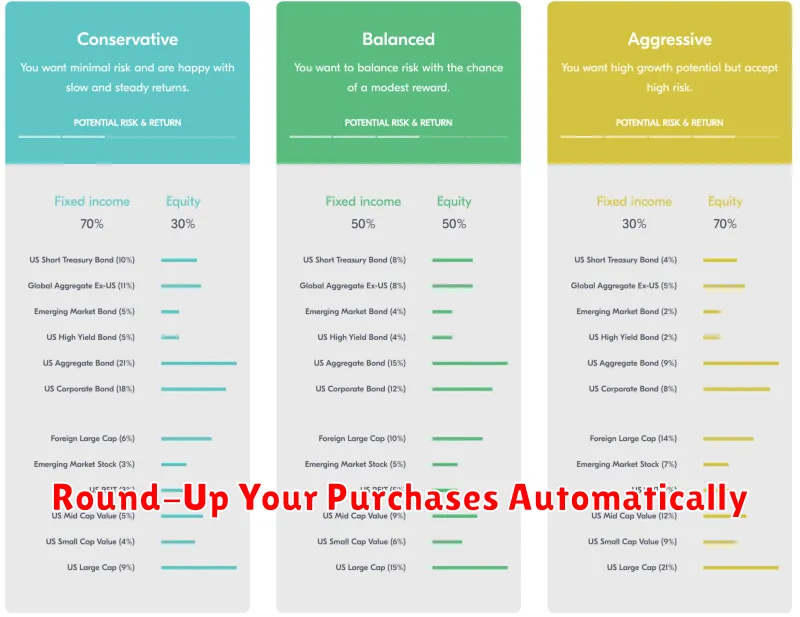

Round-Up Your Purchases Automatically

One of the most effective micro-saving strategies involves leveraging technology to automate the process. Many banking apps and dedicated savings apps now offer a round-up feature. This convenient tool automatically rounds up each of your purchases to the nearest dollar and transfers the difference to a designated savings account.

For example, if you buy a coffee for $2.75, the app will round it up to $3.00 and transfer the extra $0.25 to your savings. While it may seem insignificant on a per-transaction basis, these small amounts accumulate quickly over time. The beauty of this method is its passivity; you don’t need to actively think about saving, the system handles it for you.

Several factors contribute to the success of this approach. Firstly, the insignificant nature of the individual transactions makes it less painful than setting aside larger sums. Secondly, the automation eliminates the friction often associated with manual savings efforts. Finally, the consistent, albeit small, contributions result in a noticeable increase in savings over the long term. This makes it a truly effective and sustainable micro-saving strategy.

Consider exploring the features offered by your current banking app or researching dedicated savings apps that offer this round-up functionality. Choosing an app that integrates seamlessly with your existing spending habits is crucial for maximizing its effectiveness and ensuring long-term adherence to this valuable saving method.

Set a Weekly Challenge With Yourself

One highly effective micro-saving strategy involves setting a weekly challenge. This isn’t about drastic changes; instead, focus on small, manageable goals.

For example, you could challenge yourself to save $5 every week. This seemingly insignificant amount adds up to $260 annually. Alternatively, you could challenge yourself to forgo a daily coffee shop latte and save that money instead. The key is to choose a challenge that aligns with your lifestyle and spending habits.

Consider tracking your progress. A simple spreadsheet or a dedicated savings app can help you monitor your success and stay motivated. Visualizing your progress can be incredibly rewarding and encourage continued participation in the challenge. The sense of accomplishment from completing the weekly challenge will further motivate you to continue your saving journey.

Remember, consistency is crucial. Even if you miss a week, don’t give up! Simply get back on track the following week. The focus should be on building a habit, not achieving perfection. Gradually, you can increase the challenge amount as you become more comfortable and confident in your saving abilities.

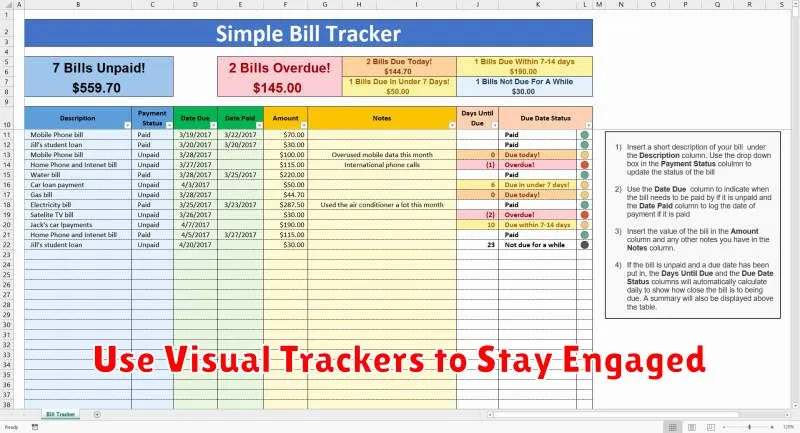

Use Visual Trackers to Stay Engaged

Maintaining motivation throughout a micro-saving journey can be challenging. The small amounts involved may feel insignificant, making it easy to lose sight of the bigger financial goal. This is where visual trackers come in handy.

A visual tracker provides a tangible representation of your progress. Whether it’s a simple jar to fill with cash, a progress bar on a spreadsheet, or a colorful chart tracking your savings over time, seeing your savings accumulate visually can be incredibly motivating.

The act of physically placing money into a jar, or updating a chart each time you save, reinforces the positive behavior and helps you visualize the growing sum. This positive reinforcement is crucial for maintaining momentum, especially during periods where you might feel tempted to deviate from your savings plan.

Consider your personality when selecting a visual tracker. Some people prefer the simplicity and tactile nature of a physical jar, while others might find a digital tracker more convenient and visually appealing. The key is to find a method that you enjoy and that keeps you actively involved in the process. The more engaged you are, the more likely you are to stick to your micro-saving goals.

Remember, the goal is to make the process fun and rewarding. A visual tracker serves as a constant reminder of your accomplishments and fuels your motivation to continue saving, ultimately leading to achieving your financial objectives.

Gamify Your Savings for Extra Motivation

Saving money can often feel like a tedious chore, but what if we told you there’s a way to make it fun? Gamification is the process of applying game-design elements and game principles in non-game contexts. By incorporating these elements into your saving strategy, you can transform the often-dreaded act of saving into an engaging and rewarding experience.

One popular method is to set up a savings challenge. This could involve a virtual “level-up” system where you reach new milestones based on your savings goals. For example, each $100 saved could unlock a new “level,” with rewards such as a small treat or a celebratory dinner. Alternatively, you could use a savings app that incorporates game mechanics, such as points, badges, or leaderboards to further boost motivation.

Another effective technique involves creating a visual representation of your progress. Think of it as a progress bar, but for your savings. Whether it’s a physical jar where you drop your spare change or a visually engaging chart in a spreadsheet, seeing your progress visually can be incredibly motivating. The more concrete and tangible the visualization, the more effective it can be. Seeing the ‘fill-up‘ of your saving jar or the climbing chart can be highly satisfying.

Consider using a rewards system tied to your savings milestones. Don’t just focus on the long-term goal; reward yourself for reaching smaller, more achievable steps along the way. These small rewards should not undermine your savings goal but should act as positive reinforcements, fostering a sense of accomplishment and encouraging continued effort. Consistency is key, so remember to celebrate your victories!

By incorporating these elements, you can turn saving from a monotonous task into an engaging journey. Remember that the key to success lies in choosing methods that are both enjoyable and sustainable for you. Experiment with different techniques to discover what works best and helps you stick to your saving goals.

Avoid the Temptation to Withdraw Early

One of the biggest hurdles to successful micro-saving is the temptation to withdraw funds prematurely. Patience is key to reaping the benefits of consistent, small contributions. While it might be tempting to access those accumulated funds for a seemingly urgent expense, doing so undermines the long-term growth potential of your savings.

Consider setting up your micro-saving account with a penalty for early withdrawals. This can serve as a powerful deterrent, helping you stay committed to your savings goals. Alternatively, you might choose an account with limited accessibility, making it more difficult to impulsively access your money.

Remember that even small, regular contributions accumulate significantly over time, thanks to the power of compound interest. Withdrawing early prevents this compounding effect and negates the advantage of consistent saving. Resist the urge to tap into your savings unless it’s for a truly unavoidable emergency.

Develop a budget that explicitly accounts for your micro-savings contributions, treating them as a non-negotiable expense. This will help you allocate funds effectively and avoid the need to raid your savings for non-essential purchases.

Visualizing your long-term financial goals can significantly bolster your self-discipline. Think about what you’ll be able to achieve with those accumulated funds – a down payment on a house, a much-needed vacation, or a comfortable retirement. Keeping these goals in mind will help you stay focused and avoid impulsive withdrawals.