Building a robust emergency fund is not merely advisable; it’s a non-negotiable financial imperative. Unexpected life events, from job loss to medical emergencies, can strike without warning, leaving individuals and families facing crippling financial hardship. A well-funded emergency fund acts as a critical safety net, providing a crucial buffer against these unforeseen circumstances and preventing a potentially devastating slide into debt. Failing to prioritize building an emergency fund is a gamble you simply cannot afford to take.

This article delves into the importance of an emergency fund, dispelling common misconceptions and outlining a practical, step-by-step strategy for establishing and maintaining one. We’ll explore how a strategically built emergency fund can provide financial security, mitigating stress and promoting long-term financial well-being. Discover why building an adequate emergency fund should be at the top of your financial priorities, regardless of your current income or financial situation. Learn how to protect your financial future today.

What Is an Emergency Fund and Why It Matters

An emergency fund is a readily accessible pool of money specifically set aside to cover unexpected expenses. It acts as a financial safety net, protecting you from the potentially devastating consequences of unforeseen events.

The importance of an emergency fund cannot be overstated. Life is unpredictable, and unexpected events, such as job loss, medical emergencies, car repairs, or home repairs, can strike at any time. Without a sufficient emergency fund, these events can quickly lead to significant debt, impacting your credit score and overall financial well-being.

A robust emergency fund provides crucial financial security, allowing you to navigate unexpected challenges without resorting to high-interest debt like credit cards or payday loans. This prevents a minor setback from snowballing into a major financial crisis, protecting your financial stability and peace of mind.

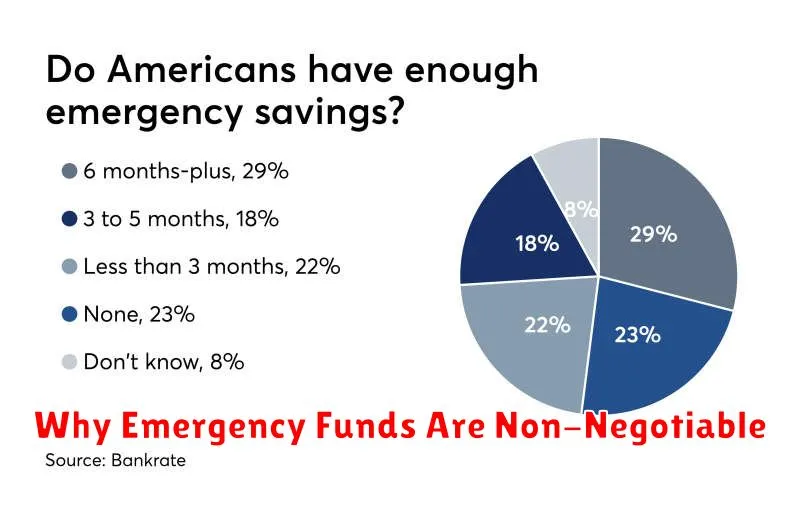

While the ideal amount varies depending on individual circumstances and risk tolerance, financial experts generally recommend having 3-6 months’ worth of living expenses saved in an emergency fund. This amount should cover essential costs such as rent or mortgage payments, utilities, groceries, and transportation.

Building an emergency fund may require discipline and sacrifice, but the long-term benefits far outweigh the short-term challenges. It’s a critical component of responsible financial planning, offering a vital buffer against the unpredictable nature of life.

How Much You Should Save Based on Income

Building a robust emergency fund is crucial for financial stability, and the amount you should save is directly tied to your income. While there’s no one-size-fits-all answer, a commonly recommended target is to have 3-6 months’ worth of living expenses saved.

For example, if your monthly expenses are $3,000, aiming for a savings goal between $9,000 and $18,000 is a good starting point. This range provides a safety net to cover unexpected events such as job loss, medical emergencies, or significant home repairs. The higher end of the range offers greater protection against prolonged or more severe financial setbacks.

Higher earners may find it beneficial to aim for a larger emergency fund, perhaps exceeding 6 months’ worth of expenses. This extra cushion can provide more financial security and peace of mind, especially when facing larger potential expenses related to a higher income lifestyle.

Conversely, individuals with lower incomes may find it challenging to reach the 3-6 month target immediately. In such cases, prioritizing building even a smaller emergency fund – perhaps 1-3 months’ worth – is an important first step. Gradually increasing savings over time, as income allows, is a sustainable approach. Remember, even a small emergency fund is better than none.

Ultimately, the ideal amount depends on your individual circumstances, including your risk tolerance, the stability of your income, and the potential for significant expenses. Consider your unique financial situation and determine a savings goal that aligns with your comfort level and long-term financial security.

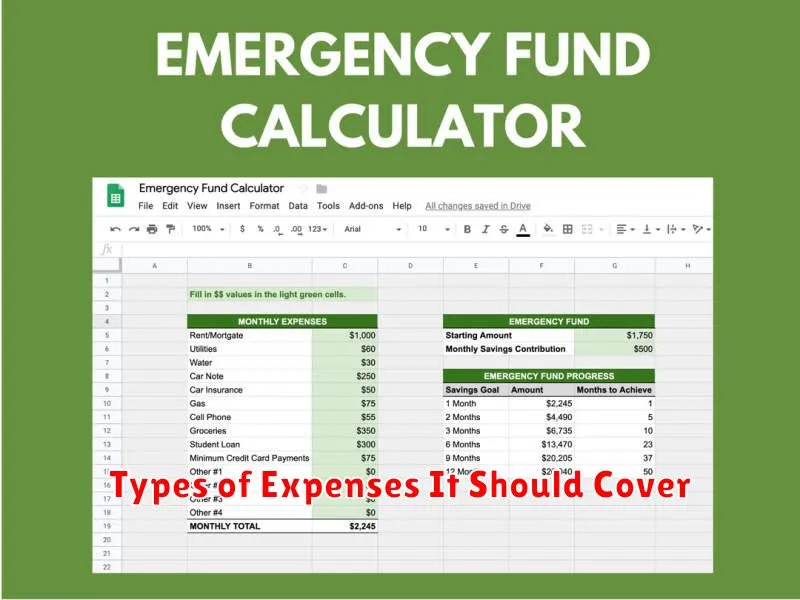

Types of Expenses It Should Cover

An emergency fund is designed to provide a financial cushion during unforeseen circumstances. Therefore, it should cover a range of potential expenses, ensuring you can navigate difficult situations without accumulating further debt.

Unexpected medical bills represent a significant reason for needing an emergency fund. Whether it’s a sudden illness, accident, or unexpected dental work, medical costs can quickly escalate, leaving you with a substantial financial burden. Your emergency fund should be large enough to cover deductibles, co-pays, and other out-of-pocket expenses related to healthcare.

Job loss is another critical scenario where an emergency fund proves invaluable. The financial impact of unemployment can be devastating, and having sufficient savings allows you to cover essential living expenses like rent or mortgage payments, utilities, groceries, and transportation while you actively search for new employment. The length of time your emergency fund should cover depends on your personal circumstances and the typical job search duration in your area.

Home repairs are unavoidable and can be unexpectedly costly. A burst pipe, malfunctioning appliance, or roof damage can quickly deplete your savings. Your emergency fund should have enough to cover these necessary repairs, preventing them from becoming major financial stressors.

Beyond the major expenses, your emergency fund should also encompass smaller, yet equally significant, unexpected costs. This could include car repairs, replacing a lost or stolen item, or covering travel expenses in the event of a family emergency. Essentially, anything that throws your budget off track should be accounted for by your emergency fund.

The specific amount needed will vary depending on individual circumstances, but a general guideline is to have 3-6 months’ worth of living expenses readily available in your emergency fund. This provides a robust safety net capable of handling a variety of unforeseen events.

How to Build It $10 at a Time

Building an emergency fund can seem daunting, especially if you’re starting from scratch or working with a tight budget. The good news is that even small, consistent contributions can make a significant difference over time. A strategy of saving just $10 a week, or even less, can lead to a surprisingly substantial emergency fund.

Consider these practical steps: First, determine a realistic savings goal. While a three- to six-month emergency fund is ideal, begin with a smaller, more achievable target, perhaps $500. Breaking down this goal into smaller, manageable chunks ($10 increments) makes the process less overwhelming and more sustainable.

Automate your savings. Many banks and financial institutions offer automatic transfers. Set up a recurring transfer of $10 (or your chosen amount) from your checking account to your savings account each week. This ensures consistent contributions without requiring constant effort.

Track your progress. Monitoring your savings growth can be incredibly motivating. Use a spreadsheet, budgeting app, or even a simple notebook to keep track of your contributions. Visualizing your progress reinforces the value of your commitment and keeps you on track.

Identify areas for extra savings. Even small adjustments to your spending habits can free up extra funds for your emergency fund. For example, bringing your lunch to work instead of eating out, reducing non-essential subscriptions, or finding less expensive alternatives for everyday purchases can contribute to your $10 weekly goal.

Remember, consistency is key. Even seemingly insignificant amounts, such as $10 a week, accumulate over time, forming a crucial safety net. Building an emergency fund isn’t about a single large deposit; it’s about establishing a sustainable savings habit. Small, regular contributions eventually lead to a substantial emergency fund that offers peace of mind and financial security.

Where to Store Your Emergency Fund

The location of your emergency fund is crucial to its accessibility and safety. You need to be able to access it quickly in a crisis, but you also want to avoid the temptation to spend it on non-emergencies.

A high-yield savings account is generally the best option. These accounts offer better interest rates than traditional savings accounts, allowing your money to grow slightly while remaining readily available. Look for accounts with FDIC insurance, ensuring your funds are protected up to a certain limit.

Money market accounts are another viable choice. Similar to savings accounts, they offer competitive interest rates and easy access to your funds. However, they may have slightly higher minimum balance requirements.

While some may consider short-term certificates of deposit (CDs), these are generally less suitable for emergency funds. Though they offer potentially higher interest rates, accessing your funds before maturity typically involves penalties. Therefore, they are better suited for longer-term savings goals.

It’s vital to avoid storing your emergency fund in retirement accounts or investment accounts. Accessing these funds prematurely often involves significant fees and tax implications, defeating the purpose of having a readily available emergency fund.

Ultimately, the ideal location for your emergency fund balances easy accessibility with security and a modest return. Carefully consider your individual financial needs and circumstances when making your decision.

Signs You’re Relying on Credit Instead

Consistent reliance on credit cards for everyday expenses is a major red flag. If you’re regularly using credit to cover groceries, utilities, or gas, you’re likely not prioritizing savings and are instead relying on borrowed money to meet your needs.

High credit card balances that persist month after month indicate a dependence on credit. Paying only the minimum payment, or worse, nothing at all, is a clear sign that you’re struggling to manage your finances and are using credit as a crutch rather than a tool.

Inability to cover unexpected expenses without resorting to credit is a strong indicator that you lack a financial safety net. A sudden car repair, medical bill, or job loss should be covered by savings, not by accumulating more debt.

Frequent use of payday loans or other high-interest loans shows a serious lack of financial stability. These types of loans are designed to trap borrowers in a cycle of debt and should be avoided at all costs. Their frequent use is a clear sign of a critical need for emergency savings.

Difficulty meeting minimum payments on your debts, or experiencing late payments, signals a precarious financial situation. Consistent late payments negatively impact your credit score, further limiting your financial options and making it even harder to manage your finances effectively.

Stress and anxiety surrounding finances can be a significant indicator of relying too heavily on credit. The constant worry of upcoming payments and mounting debt can significantly impact your mental and physical well-being.

Applying for new credit frequently demonstrates a pattern of using credit to solve financial problems rather than addressing the underlying issue of insufficient savings. This is a dangerous cycle that often leads to overwhelming debt.