Saving money doesn’t have to be a daunting task. Many believe that building a robust financial foundation requires significant lifestyle changes and complex strategies. However, this couldn’t be further from the truth. This article will debunk the myth that saving money is complicated, offering practical, straightforward tips and techniques to help you achieve your financial goals, no matter your income level. We’ll explore simple yet effective methods to save money without drastically altering your lifestyle, empowering you to take control of your finances and build a secure financial future.

Whether you’re aiming to save for a down payment on a house, planning for retirement, or simply looking to improve your overall financial health, this guide provides actionable steps you can implement immediately. We’ll cover various money-saving strategies, including budgeting techniques, smart spending habits, and effective ways to reduce unnecessary expenses. Discover how to make saving money a manageable and sustainable part of your life, ultimately leading to a more financially secure and fulfilling future. Learn to maximize your savings without sacrificing your enjoyment of life.

Start With a Simple Weekly Transfer Plan

Saving money can feel daunting, but it doesn’t have to be a complex undertaking. A simple and effective strategy is to implement a weekly transfer plan. This involves automatically transferring a predetermined amount of money from your checking account to a dedicated savings account each week.

The beauty of this approach lies in its automation. By setting up a recurring transfer, you eliminate the need for constant willpower and decision-making. The money is moved before you even have a chance to spend it, making it a highly effective method for consistent saving.

Start small. Even transferring a modest amount, such as $20 or $50, each week can add up significantly over time. Once you’ve established this habit, you can gradually increase the transfer amount as your financial situation allows. The key is to find an amount that is both manageable and meaningful to your savings goals.

Consider using your bank’s online banking features or a budgeting app to automate the transfer. Many financial institutions offer this service, making the process seamless and convenient. This method helps you build good financial habits and steadily achieve your savings goals without significant effort.

Remember, consistency is key. Sticking to your weekly transfer plan, regardless of minor fluctuations in your income, is crucial for building a strong savings foundation. This simple, yet powerful, strategy can pave the way for achieving your financial aspirations.

Use Visual Tools to Stay Motivated

Saving money can sometimes feel like a long, arduous journey. It’s easy to lose sight of your goals and become discouraged. That’s where visual tools come in handy. They provide a tangible representation of your progress, keeping you motivated and engaged throughout the process.

One effective method is creating a savings tracker. This could be a simple spreadsheet, a dedicated notebook, or even a visually appealing chart. Regularly updating your tracker allows you to see your accumulated savings grow, providing a powerful sense of accomplishment and reinforcing your commitment.

Another helpful visual tool is a savings goal jar or a similar physical representation. Each time you save a certain amount, add something to the jar—whether it’s physical money or small tokens representing your progress towards your financial goals. Seeing the jar fill up offers a satisfying visual cue of your success and serves as a constant reminder of your financial aspirations.

Consider using a progress bar or a visual representation of your savings journey. Many budgeting apps offer this feature, dynamically showing your progress towards a specific savings target. This gamified approach can make saving money more fun and less of a chore, increasing your adherence to your financial plan.

Ultimately, the best visual tool is the one that works best for you. Experiment with different methods to discover what keeps you motivated and on track. The key is to find a visual representation that you find engaging and that consistently reminds you of your financial objectives.

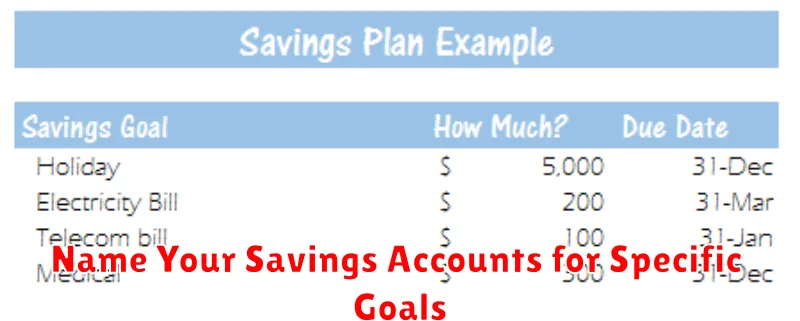

Name Your Savings Accounts for Specific Goals

One of the most effective strategies for boosting your savings is to create a system of named savings accounts. Instead of having one generic savings account, consider opening several accounts, each dedicated to a specific financial goal. This simple tactic can significantly improve your savings success.

For example, you might have an account named “Emergency Fund” for unexpected expenses, a “Down Payment” account for a house or car, a “Vacation Fund” for your next getaway, or a “Home Improvement” account for renovations.

The power of this approach lies in its psychological impact. Giving each account a clear, specific name visualizes your goals and keeps you motivated. When you see the balance growing in your “Vacation Fund,” you’re more likely to stay disciplined and continue saving for that trip. This method transforms saving from an abstract concept into a series of tangible objectives.

Furthermore, this strategy facilitates better budgeting and tracking. By allocating funds to individual accounts, you can clearly see where your money is going and how much progress you’re making towards each goal. This clarity makes it easier to adjust your spending habits and prioritize your savings accordingly.

Consider using a spreadsheet or budgeting app to further enhance this system. You can track the progress of each account and set realistic savings targets for each goal. This detailed approach allows for better financial planning and increased accountability.

Automate Everything to Remove Decision Fatigue

Decision fatigue is a real phenomenon. Making countless small decisions throughout the day, from what to eat for breakfast to which route to take to work, can significantly deplete your mental resources. This leaves you less capable of making sound financial decisions later in the day, often leading to impulsive purchases or neglecting important savings strategies.

Automating aspects of your finances can significantly reduce this decision fatigue. By setting up automatic bill payments, you eliminate the daily or weekly task of remembering and paying each bill. This frees up mental energy for more important tasks and reduces the risk of late fees.

Consider automating your savings as well. Setting up automatic transfers from your checking account to your savings account, even a small amount each week or month, ensures consistent saving without requiring conscious effort. This is particularly helpful for building an emergency fund or achieving long-term financial goals.

Investing can also benefit from automation. Many brokerage accounts offer features that allow you to automatically invest a predetermined amount on a regular schedule. This “dollar-cost averaging” strategy can be an effective way to build wealth over time without needing to constantly monitor market fluctuations.

Beyond finances, automating other daily tasks can indirectly support your savings goals. Automating grocery delivery, for example, can prevent impulse buys at the supermarket. Similarly, using subscription services for household goods eliminates the need for frequent shopping trips, saving both time and money.

By strategically automating various aspects of your life, you can free up cognitive resources, reduce stress, and ultimately make better financial decisions, paving the way for greater savings.

Track Progress With Monthly Reviews

Saving money effectively requires more than just setting a goal; it necessitates consistent monitoring and adjustment. Regular reviews are crucial to stay on track and identify areas needing improvement.

We recommend conducting monthly reviews of your budget and spending habits. This provides a valuable opportunity to assess your progress towards your financial objectives. During these reviews, analyze your spending patterns, noting areas where you’ve exceeded your budget or where you’ve successfully saved more than anticipated.

Consider using a budgeting app or a simple spreadsheet to track your income and expenses. This will simplify the review process and provide a clear picture of your financial health. The visual representation of your spending will make it easier to identify areas for potential savings.

During your monthly review, re-evaluate your budget. Life circumstances change, and your spending needs might fluctuate. Adjust your budget to reflect these changes, ensuring it remains realistic and achievable. This proactive approach will prevent unexpected financial setbacks.

The consistent monitoring provided by monthly reviews fosters a sense of accountability and reinforces your commitment to saving. It’s a proactive step towards building healthy financial habits and achieving your long-term financial goals. Celebrating small victories along the way will further enhance motivation and sustain your efforts.

Reward Yourself With Free or Low-Cost Celebrations

Saving money doesn’t mean you have to forgo celebrations entirely. In fact, rewarding yourself for reaching financial goals is a great way to stay motivated. The key is to find creative ways to celebrate without breaking the bank. Think about what truly makes you happy and find affordable alternatives to traditional celebrations.

Free options abound. A picnic in the park with friends and family is a wonderful way to enjoy good company and delicious food without any significant cost. Similarly, a game night at home with loved ones, complete with homemade snacks, can be both fun and budget-friendly. Consider organizing a potluck dinner where everyone contributes a dish, sharing the cost and expanding the variety of food.

If you’re looking for something a little more involved, consider low-cost alternatives. A hike or bike ride in a scenic location offers both exercise and enjoyment at minimal expense. Visiting a local museum or art gallery on a free admission day or taking advantage of discounted rates can be a fulfilling and educational experience. Exploring a nearby town or city, perhaps finding a free walking tour, provides an opportunity for adventure without exorbitant spending.

Remember that the most important aspect of a celebration is the quality time spent with loved ones. Focusing on meaningful connections and creating lasting memories is far more valuable than the monetary value of the celebration itself. By shifting your focus to experiences rather than expensive material items, you can celebrate your successes without compromising your financial goals.