Building long-term wealth isn’t about striking it rich overnight; it’s a marathon, not a sprint. This requires consistent effort and the cultivation of sound daily money habits. Developing a strong financial foundation demands discipline and a proactive approach to managing your finances. This article will explore practical, actionable daily habits that can significantly impact your financial future, leading you towards achieving your wealth-building goals. Discover how simple, everyday actions can pave the way for long-term financial security and sustainable wealth creation.

From mastering budgeting and saving to strategically managing debt and investing, we’ll delve into the specific daily practices that high-net-worth individuals employ. Learn how to cultivate a mindset of financial literacy and make informed decisions to optimize your income and expenses. Understand the power of compound interest and how consistent saving and investing habits can exponentially grow your wealth over time. This guide provides a roadmap to financial freedom, empowering you to take control of your financial destiny and build lasting wealth.

Start Every Morning With a Quick Budget Review

Beginning your day with a brief overview of your budget is a powerful habit that can significantly impact your financial well-being. It’s not about meticulously tracking every penny, but rather a quick check-in to maintain awareness of your spending and ensure you’re staying on track with your financial goals.

This morning ritual doesn’t need to be time-consuming. Simply glancing at your budget summary, noting any significant transactions from the previous day, and confirming you are within your planned spending limits can make a profound difference. This consistent monitoring helps you identify potential issues early on, preventing them from spiraling into larger problems.

Consider using a budgeting app or spreadsheet to simplify this process. Many budgeting tools offer daily or weekly summaries, providing you with a clear snapshot of your current financial standing. The key is to choose a method that fits your lifestyle and that you’ll actually use consistently.

By incorporating this simple yet effective practice into your daily routine, you’ll cultivate a mindset of financial mindfulness. This proactive approach to managing your finances will empower you to make informed decisions, achieve your financial aspirations, and build long-term wealth more efficiently.

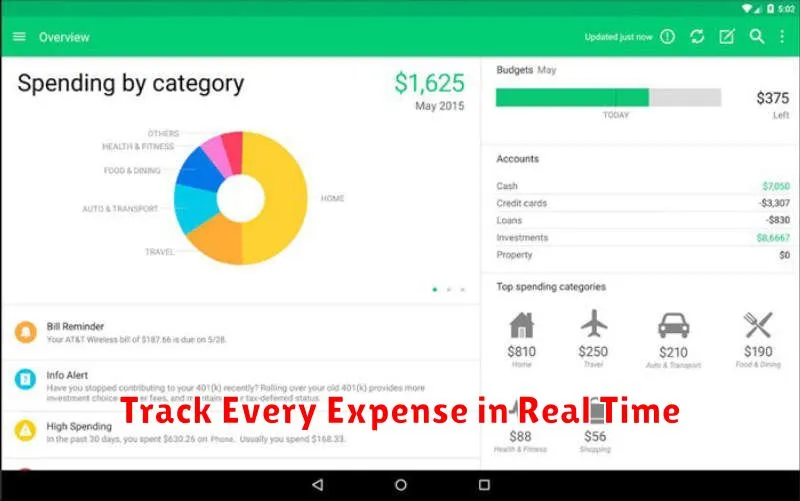

Track Every Expense in Real Time

One of the most crucial steps towards achieving long-term financial success is diligently tracking your expenses. Many individuals underestimate the impact of seemingly small daily purchases; however, these small amounts accumulate rapidly, significantly affecting your overall financial health.

Real-time expense tracking offers unparalleled advantages. By monitoring your spending as it happens, you gain an immediate understanding of your financial habits. This allows for quick adjustments and prevents impulsive purchases that can derail your budget.

There are several methods for achieving this. Budgeting apps are a popular and convenient option, often offering features like automated categorization, expense visualization, and goal setting. Alternatively, maintaining a simple spreadsheet or using a notebook can also prove effective, particularly for those who prefer a more manual approach.

Regardless of the method chosen, the key is consistency. Make it a habit to record every expense, no matter how insignificant it may seem. This commitment to accuracy will provide you with the clearest possible picture of your financial situation, empowering you to make informed decisions about your spending and saving.

Immediate feedback is a major benefit of real-time tracking. You can identify areas of overspending almost instantaneously and make necessary adjustments. This proactive approach prevents small leaks from becoming significant financial burdens in the long run.

By embracing real-time expense tracking, you’re taking a proactive step toward managing your finances effectively. This fundamental habit fosters awareness, discipline, and ultimately, contributes significantly to building long-term wealth.

Use the 24-Hour Rule Before Any Purchase

One of the most effective strategies for improving your financial health is to implement the 24-hour rule before making any purchase, regardless of the amount. This simple yet powerful technique allows you to introduce a crucial element of mindfulness into your spending habits.

The process is straightforward: Before buying anything beyond small, everyday expenses, wait 24 hours. During this time, reflect on whether the purchase is truly necessary, if it aligns with your financial goals, and if there are more affordable alternatives. This delay often reveals impulsive spending decisions, allowing you to avoid unnecessary expenses.

The 24-hour rule helps to separate your emotions from your spending. Often, we make purchases based on immediate desires or emotional triggers rather than rational needs. This cooling-off period allows emotions to subside, leaving you with a clearer perspective on whether the purchase is a worthwhile investment of your hard-earned money.

By consistently employing the 24-hour rule, you’ll cultivate a more conscious relationship with your money. This practice significantly reduces impulsive purchases, leading to substantial savings over time. This saved money can then be directed toward more meaningful goals, such as paying down debt, investing for retirement, or building an emergency fund. It’s a powerful tool for anyone looking to take control of their finances and achieve long-term wealth.

Set a Daily Spending Limit and Stick to It

One of the most effective ways to manage your finances and build long-term wealth is to establish a daily spending limit and diligently adhere to it. This simple yet powerful strategy helps you gain control over your finances and prevents impulsive spending.

Begin by tracking your spending for a few weeks to understand your typical daily expenditures. Identify areas where you can easily reduce spending. Once you have a clear picture, set a realistic daily limit. This limit should cover essential expenses like groceries and commuting, leaving some room for occasional treats but still promoting mindful spending. It’s crucial to choose a limit you can comfortably maintain.

Consider using budgeting apps or a simple spreadsheet to monitor your daily spending. These tools help visualize how much you’re spending and provide a clear indication of whether you are staying within your set limit. Regularly reviewing your spending helps you identify patterns and adjust your limits if needed. Remember that the goal isn’t to deprive yourself but to cultivate a conscious relationship with your money.

Sticking to your daily spending limit requires discipline and self-awareness. It involves consciously making choices about how you spend your money, prioritizing needs over wants, and delaying gratification when necessary. This practice, over time, builds valuable financial discipline and ultimately contributes to your long-term financial well-being. The more consistent you are in adhering to your daily limit, the greater your chances of achieving your financial goals.

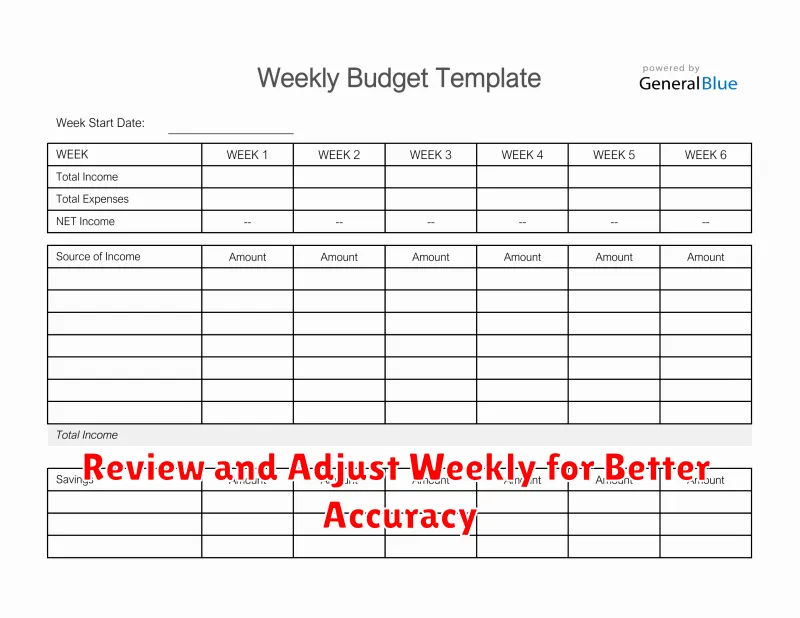

Review and Adjust Weekly for Better Accuracy

Tracking your daily finances is crucial, but it’s equally important to step back and review your progress on a weekly basis. This allows you to identify trends and make necessary adjustments to your budget and spending habits. Without this regular review, small discrepancies can accumulate, leading to inaccurate assessments of your financial health.

A weekly review provides an opportunity to identify areas where you’re overspending or undersaving. Perhaps you’re exceeding your allocated amount for groceries or entertainment. By noting these deviations early, you can proactively adjust your spending plan to stay on track towards your financial goals. This proactive approach prevents the need for drastic measures later on.

Consider using a spreadsheet or a budgeting app to simplify this process. These tools often offer features that allow for easy visualization of your spending patterns, making it simpler to pinpoint areas for improvement. Regularly reviewing these tools allows you to see the big picture of your finances, rather than just focusing on the daily minutiae.

Don’t just focus on the numbers; reflect on your spending behaviors. Were there unexpected expenses? Did you make impulsive purchases? Identifying these patterns helps you develop strategies to better manage your finances in the future. This self-awareness is a cornerstone of long-term financial success.

The key is to make this weekly review a consistent part of your routine. Treat it like any other important appointment. The time invested will pay off handsomely in the form of improved financial accuracy and a stronger sense of control over your financial well-being.

Celebrate Small Wins Without Spending More

Building long-term wealth requires consistent effort and positive reinforcement. While grand celebrations are tempting after significant financial milestones, it’s equally important to acknowledge and celebrate smaller wins along the way. This positive reinforcement helps maintain motivation and reinforces good financial habits without breaking the bank.

Instead of expensive dinners or shopping sprees, consider these budget-friendly ways to celebrate your progress:

- Enjoy a free activity: A hike in nature, a picnic in the park, or a board game night with loved ones are all excellent alternatives to costly entertainment.

- Indulge in a small, affordable treat: A cup of your favorite coffee, a piece of delicious dark chocolate, or a new book can provide a sense of accomplishment without significant expense.

- Take a break: Use the achievement as an excuse for a relaxing evening at home. Put your feet up, read a book, or watch a movie – simple relaxation can be incredibly rewarding.

- Treat yourself to a self-care ritual: A long bath, a face mask, or a quiet meditation session can help you celebrate your success in a calm and restorative manner.

- Reflect and plan: Take time to review your progress and plan for the next financial goal. This act of planning itself can be very rewarding and sets the stage for further success.

Remember, the key is to recognize and appreciate the effort you put in. Celebrating small wins cultivates a positive mindset, essential for sustaining financial discipline and ultimately achieving your long-term financial objectives.