Are you tired of living paycheck to paycheck? Do you dream of financial freedom and the ability to comfortably meet your financial goals? Many individuals find themselves trapped in this cycle, constantly struggling to make ends meet. This persistent financial stress can impact every aspect of your life, from your mental health to your relationships. This comprehensive guide, “How to Break the Paycheck-to-Paycheck Cycle for Good,” will provide you with practical strategies and actionable steps to escape this cycle and build a secure financial future.

We’ll delve into proven methods for budgeting and saving money, exploring techniques like the 50/30/20 rule and zero-based budgeting. You’ll learn how to identify and eliminate unnecessary expenses, negotiate lower bills, and discover opportunities to increase your income. Furthermore, we’ll discuss the importance of building an emergency fund, understanding debt management, and developing a long-term financial plan to achieve lasting financial stability. This guide offers a roadmap to reclaim control of your finances and achieve true financial wellness.

Understand Where Your Money Is Going First

Breaking the paycheck-to-paycheck cycle requires a fundamental shift in your relationship with money. The first, and arguably most crucial, step is to gain a clear understanding of your current spending habits. Many people are surprised by how much they spend on seemingly insignificant items.

To achieve this clarity, you need to meticulously track your income and expenses. There are several methods to accomplish this: you can utilize budgeting apps, spreadsheets, or even a simple notebook. The key is consistency; track every dollar that comes in and goes out for at least one month, ideally two or three, to get a truly representative picture.

As you track your spending, categorize your expenses. This allows you to pinpoint areas where your money is going and identify potential areas for reduction. Common categories include housing, transportation, food, utilities, entertainment, and debt payments. Be thorough; even small expenses add up over time.

Once you have a comprehensive overview of your finances, you’ll be able to identify patterns and areas where you can make changes. This process of honest self-assessment is essential for effectively managing your money and breaking free from the paycheck-to-paycheck cycle.

Build a Mini Emergency Fund

Breaking the paycheck-to-paycheck cycle requires a proactive approach to managing your finances. One crucial step is establishing an emergency fund, even a small one. This isn’t about accumulating a massive sum overnight; it’s about building a safety net to handle unexpected expenses.

Start with a mini emergency fund, aiming for just $500 to $1000. This smaller goal is more attainable and less daunting than saving a full three to six months’ worth of expenses, making it ideal for those just beginning their journey to financial stability. This fund can cover minor emergencies such as unexpected car repairs or medical bills, preventing you from resorting to high-interest debt.

Consistency is key. Even setting aside a small amount, such as $25 or $50 per paycheck, will steadily build your fund. Automate your savings by setting up recurring transfers from your checking account to a dedicated savings account specifically for emergencies. This removes the temptation to spend the money and makes saving effortless.

Track your progress. Regularly review your emergency fund balance to monitor your progress and stay motivated. Seeing your savings grow, even in small increments, can be incredibly rewarding and reinforce the importance of your financial plan. Remember, this is a foundation for greater financial security.

Once you’ve reached your mini emergency fund goal, consider increasing your savings target to build a more substantial emergency fund. The sense of security and control that comes from having even a small emergency fund is invaluable in escaping the paycheck-to-paycheck cycle.

Pay Yourself First Before Spending

Breaking the paycheck-to-paycheck cycle requires a fundamental shift in mindset: pay yourself first. This means allocating a portion of your income to savings and investments before you pay any other bills or expenses.

Many people operate on the principle of paying all their bills and then saving whatever is left. This approach often leaves little to nothing for savings, perpetuating the cycle. By prioritizing savings, you ensure that you’re consistently building wealth, regardless of unexpected expenses or fluctuations in income.

The amount you allocate to yourself depends on your individual circumstances and financial goals. A common recommendation is to save at least 10-20% of your income. However, even smaller amounts saved consistently can make a significant difference over time. Consider automating this process by setting up automatic transfers to your savings account on payday. This removes the temptation to spend the money elsewhere.

Consistency is key. Treat your savings contributions as non-negotiable expenses, just like your rent or mortgage. By adhering to this principle, you’ll build a solid financial foundation and reduce your reliance on living paycheck to paycheck.

Implementing a “pay yourself first” strategy involves careful budgeting and disciplined spending. Tracking your expenses and identifying areas where you can cut back will free up additional funds to allocate towards your savings goals. This conscious effort to prioritize your financial well-being will ultimately lead to long-term financial stability and freedom.

Separate Fixed and Variable Expenses

Breaking free from the paycheck-to-paycheck cycle requires a clear understanding of your spending habits. The first crucial step is to differentiate between your fixed and variable expenses. This categorization provides a framework for effective budgeting and financial management.

Fixed expenses are those costs that remain relatively consistent each month, regardless of your spending habits. These typically include essential payments such as rent or mortgage payments, car loan payments, insurance premiums (auto, health, home), and student loan payments. Understanding these predictable outflows allows for accurate budgeting and prevents unexpected financial strain.

In contrast, variable expenses are more fluid and fluctuate from month to month. These include costs like groceries, utilities (electricity, water, gas), gasoline, entertainment, clothing, and dining out. While these expenses are necessary, their variability offers opportunities for significant savings. Careful tracking and conscious spending choices within this category can dramatically improve your financial situation.

By meticulously separating these two expense types, you can gain a comprehensive overview of your financial landscape. This allows for informed decisions on where to prioritize savings and where potential cost reductions can be implemented. This clear distinction is the foundation for building a sustainable budget and escaping the paycheck-to-paycheck cycle for good.

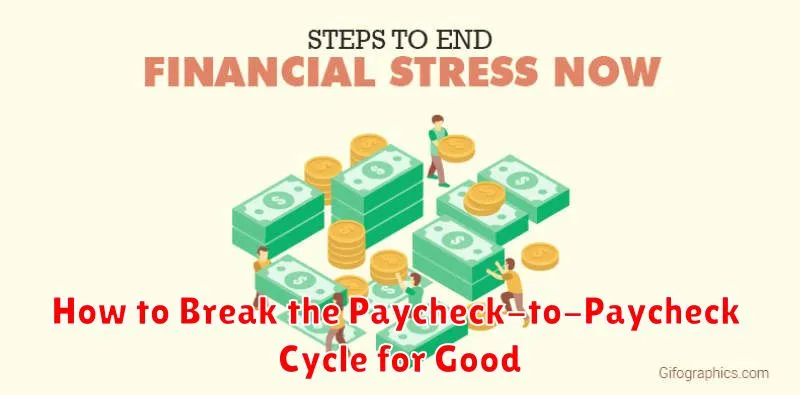

Use a Paycheck Planning System

Breaking the paycheck-to-paycheck cycle requires a proactive approach to managing your finances. A key component of this is implementing a robust paycheck planning system. This system should help you track your income and expenses effectively, allowing you to anticipate and prepare for upcoming financial obligations.

Budgeting is fundamental to any effective paycheck planning system. You need to understand where your money is going. Categorize your expenses—housing, transportation, food, entertainment, etc.—and track your spending diligently. There are many budgeting apps and spreadsheet templates available to simplify this process. The goal is to create a realistic budget that aligns with your income and allows for savings.

Beyond budgeting, a comprehensive system involves forecasting future expenses. Anticipate upcoming bills like car insurance renewals, property taxes, or holiday spending. By proactively planning for these expenses, you’ll avoid unexpected financial shortfalls. Consider setting aside money each paycheck specifically for these anticipated costs.

Automation can significantly enhance your paycheck planning system. Set up automatic transfers to your savings and investment accounts each pay period. Automating bill payments ensures timely payments and avoids late fees. This automated approach minimizes the risk of overlooking important financial obligations.

Finally, regular review and adjustment are crucial. Your financial situation can change, so your paycheck planning system needs to be adaptable. Periodically review your budget and spending habits to ensure your system continues to effectively manage your finances. Make adjustments as needed to keep your finances on track.

Increase Gaps Between Paycheck and Expenses

Breaking the paycheck-to-paycheck cycle requires a fundamental shift in your financial approach. A crucial step is to actively increase the gap between the money you earn and the money you spend. This isn’t about extreme deprivation; it’s about creating a buffer that provides financial security and freedom.

One effective strategy is to meticulously track your expenses. Use budgeting apps, spreadsheets, or even a simple notebook to monitor where your money is going. Identifying areas of overspending is the first step towards reducing unnecessary expenditures. This detailed analysis allows for informed decision-making regarding your spending habits.

Once you have a clear picture of your spending, prioritize paying off high-interest debt. The interest payments on credit cards and other high-interest loans significantly eat into your income, keeping you trapped in the paycheck-to-paycheck cycle. Aggressive debt repayment, such as through the debt avalanche or snowball method, frees up considerable funds that can then be directed towards increasing your savings.

Simultaneously, explore ways to increase your income. This might involve seeking a raise at your current job, taking on a part-time job, or exploring opportunities for freelance work. Even small increases in income can significantly impact your ability to build a financial cushion.

Finally, diligently save and invest any extra money. Start by building an emergency fund that covers 3-6 months of living expenses. This fund acts as a safety net, preventing you from dipping into debt during unexpected financial emergencies. Once the emergency fund is established, consider investing a portion of your savings for long-term growth.