Are you constantly feeling financially strained, despite your best efforts? You might be surprised to learn that seemingly harmless financial habits are secretly draining your wallet. This article delves into common yet often overlooked money mistakes that can significantly impact your financial well-being. We’ll uncover the hidden culprits behind your dwindling savings and reveal practical strategies to reclaim control of your finances. Discover how seemingly insignificant daily spending habits can accumulate into substantial financial losses over time, leaving you wondering where your money went.

From the seemingly innocuous subscription trap to the insidious lure of impulse purchases, we’ll examine a range of bad financial habits that can sabotage even the most meticulously planned budgets. Learn to identify these hidden financial leaks and implement effective solutions to build a more secure financial future. This article provides actionable advice and empowering strategies to help you break free from these detrimental habits and cultivate sound financial practices. Take control of your finances and start building lasting wealth today.

Subscription Overload: How Many Is Too Many?

In today’s digital age, subscribing to various services has become incredibly convenient. From streaming platforms to software subscriptions, the options are seemingly endless. However, this convenience often comes at a cost – a cost that can significantly impact your financial health if left unchecked.

The question of “how many subscriptions is too many?” is highly individual and depends on your income and spending habits. There’s no magic number, but consider the following: Do you actively use each subscription? Are you paying for features you rarely utilize? Could you consolidate services to reduce redundancy? For example, do you truly need both Netflix and Hulu, or could one suffice? Analyzing your usage is crucial to identifying unnecessary expenditures.

A helpful exercise is to categorize your subscriptions. Separate essential services (like cloud storage for work) from non-essential ones (like gaming platforms or niche streaming services). Focus on trimming down the non-essential category, prioritizing those that provide the most value for your money and usage. Be honest with yourself: if you haven’t accessed a service in several months, it’s likely a candidate for cancellation.

Tracking your subscription costs can be surprisingly revealing. Many people are unaware of the cumulative impact of several seemingly small monthly fees. Using a spreadsheet or budgeting app to monitor these expenses will give you a clearer picture of where your money is going and help you identify areas for improvement. By proactively managing your subscriptions, you can regain control over your finances and avoid the often-unnoticed drain on your wallet.

Remember, cutting back on subscriptions isn’t about deprivation; it’s about making informed decisions about your spending and prioritizing what truly matters. It’s about making your money work for you, rather than letting it slip away on unused services.

Frequent Small Purchases Add Up

Many individuals underestimate the cumulative impact of seemingly insignificant daily expenses. These small purchases, often made without much thought, can significantly drain your finances over time. A daily coffee, a quick snack from a vending machine, or a spontaneous online purchase might seem inconsequential in isolation, but when aggregated across a week, month, or year, the total cost can be surprisingly substantial.

Consider the power of compounding, but in reverse. Instead of accruing interest on savings, you’re accumulating debt or lost potential savings from these small, recurring expenditures. A seemingly harmless $5 daily coffee habit translates to approximately $150 per month and a staggering $1800 annually. This figure represents a considerable amount that could be used for more significant financial goals, such as saving for a down payment, paying off debt, or investing.

The insidious nature of these small purchases lies in their lack of immediate pain. Unlike a large, one-time expense, the daily drain is almost imperceptible. This makes it easier to justify and continue the behavior, perpetuating a cycle of seemingly insignificant spending with significant long-term consequences. To combat this, implementing a budget and actively tracking expenses can be extremely effective. This provides a clear picture of where your money is going and helps identify areas where you can reduce spending, ultimately freeing up resources for more meaningful financial investments.

Developing a mindful approach to spending is crucial. Before making a small purchase, ask yourself if it’s truly necessary or if it aligns with your financial goals. Learning to distinguish between wants and needs is a crucial skill in managing personal finances and preventing the gradual erosion of your savings through seemingly insignificant daily purchases.

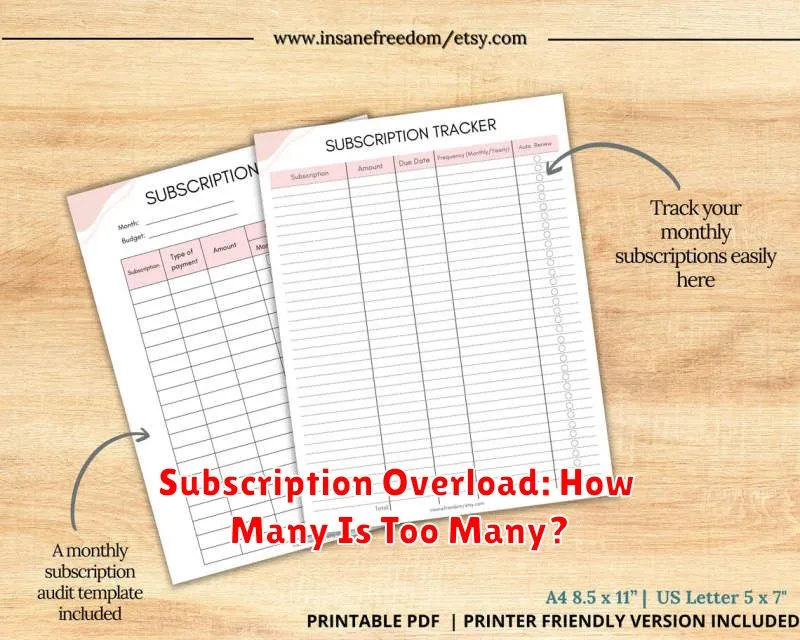

Impulse Buying Triggered by Social Media

Social media platforms are masterfully designed to trigger impulse buying. The constant stream of targeted advertisements, influencer endorsements, and visually appealing product showcases creates a fertile ground for unplanned purchases.

Algorithms personalize feeds to highlight items aligning with users’ interests and past browsing history. This hyper-targeted approach makes it incredibly easy to fall prey to the temptation of acquiring something “just because” it’s conveniently presented. The sense of FOMO (fear of missing out) is frequently leveraged, further incentivizing immediate action.

Many social media campaigns promote a sense of urgency or scarcity, highlighting limited-time offers or dwindling stock. These tactics tap into our psychological desire for instant gratification and fear of losing out on a good deal, often overriding rational decision-making processes.

The curated nature of social media presents an unrealistic portrayal of lifestyles and possessions. Seeing others flaunting their latest purchases can induce feelings of inadequacy and a desire to emulate their seemingly perfect lives, leading to unnecessary spending in an attempt to keep up with perceived trends.

Furthermore, the effortless nature of online shopping—the ability to purchase items with a few simple clicks—significantly lowers the barrier to impulse buying. The lack of physical interaction with the product, the immediate gratification of the purchase, and the ease of online transactions all contribute to increased financial vulnerability.

Over-Reliance on Food Delivery Services

The convenience of food delivery apps is undeniable. With a few taps on your phone, a meal arrives at your doorstep, eliminating the need for grocery shopping, cooking, and even dishwashing. However, this convenience comes at a significant cost, often exceeding what many realize. Over-reliance on these services can quickly drain your finances.

Firstly, delivery fees themselves can add up substantially. These fees, combined with service charges and tips, inflate the price of your meal considerably. What might have cost $15 at a restaurant easily becomes $25 or more with delivery. This seemingly small increase multiplies quickly over time, resulting in a substantial monthly expense.

Secondly, the ease of ordering often leads to increased frequency. Because it’s so simple, you might find yourself ordering more often than you would if you had to cook or go out to eat. This increased frequency translates directly into higher overall spending on food.

Thirdly, food delivery apps frequently tempt users with promotions and discounts, creating a false sense of saving money. While these deals might seem attractive, they can often encourage impulsive orders, leading to spending more than you initially intended. The psychological impact of these deals frequently overshadows the actual cost savings.

Finally, the lack of control over portion sizes and nutritional content can also indirectly impact your finances. Larger portions from delivery services often mean increased food waste, adding another layer of unnecessary expense to the equation.

Forgetting to Cancel Free Trials

One sneaky way money leaks out of your wallet is through forgotten free trials. Many services, from streaming platforms to software subscriptions, offer enticing free trial periods. The convenience of immediate access often overshadows the need for proactive cancellation.

The problem arises when the trial ends. Without a reminder or diligent cancellation, you’re automatically enrolled in a paid subscription. These seemingly small monthly charges accumulate over time, significantly impacting your budget. What starts as a free taste can quickly turn into an unwanted and expensive commitment.

To avoid this financial pitfall, adopt a proactive approach. Mark the end date of each free trial in your calendar or use a reminder app. Consider canceling the service a few days before the trial concludes to ensure you avoid any processing delays or accidental charges. Alternatively, many services offer a simple ‘cancel’ button within the account settings.

Careful management of free trials is crucial for maintaining financial control. Remember that even seemingly insignificant expenses add up. By diligently canceling unused free trials, you can prevent these hidden costs from silently depleting your savings.

Neglecting Regular Price Comparisons

One of the most insidious ways to drain your wallet is through the simple act of neglecting regular price comparisons. In today’s digital age, finding the best deals on goods and services is easier than ever, yet many people fail to take advantage of readily available resources.

Failing to compare prices before making a purchase, whether it’s for groceries, electronics, or even insurance, can lead to significant overspending over time. Even seemingly small differences in price can add up considerably across multiple purchases. For example, consistently buying a slightly more expensive brand of a product without checking for alternatives can result in a substantial loss of money annually.

The convenience of online shopping, while beneficial, can also contribute to this problem. The ease of one-click purchasing often overshadows the importance of taking a few extra minutes to search for lower prices. Developing a habit of checking several retailers or using price comparison websites before committing to a purchase is essential to responsible financial management.

Beyond tangible goods, this principle extends to services as well. Insurance premiums, subscription fees, and utility providers often have varying rates. Actively comparing offers from different companies can unlock significant savings. This proactive approach to cost comparison is a crucial element in protecting your financial well-being.

In short, the seemingly minor act of skipping price comparisons is a silent thief quietly emptying your wallet. By incorporating regular price comparisons into your spending habits, you can gain control of your finances and significantly reduce unnecessary expenditures.