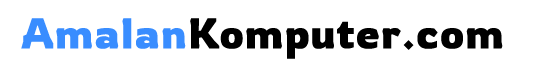

Are you tired of constantly struggling to make ends meet? Do you dream of a life where you’re not constantly stressed about money? Building a smart budget isn’t about deprivation; it’s about gaining control of your finances and achieving your financial goals. This comprehensive guide, “How to Build a Smart Budget That Fits Your Life,” will empower you to create a personalized budgeting plan that aligns with your unique lifestyle and aspirations. Learn practical strategies for tracking expenses, identifying areas for savings, and achieving financial freedom.

This article provides a step-by-step approach to crafting a budget that truly works for you. We’ll explore different budgeting methods, from the 50/30/20 rule to zero-based budgeting, helping you choose the approach that best suits your personality and financial situation. Discover how to set realistic financial goals, automate your savings, and build a strong financial foundation for a secure and prosperous future. Prepare to transform your relationship with money and unlock a life of financial wellness.

Choose a Budgeting Method That Matches Your Personality

Creating a budget isn’t a one-size-fits-all endeavor. What works wonders for one person might feel restrictive and ultimately unsustainable for another. The key to successful budgeting lies in selecting a method that aligns with your personality and lifestyle.

Zero-based budgeting, for instance, involves allocating every dollar you earn to a specific category, ensuring your income equals your expenses. This approach is ideal for individuals who appreciate structure and meticulous tracking. It provides a clear picture of your financial situation and encourages mindful spending.

Conversely, the 50/30/20 rule offers a simpler framework. It suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This method is perfect for those who prefer a less intricate approach and find comfort in general guidelines. Its flexibility allows for adjustments based on individual priorities.

For those who thrive on visual representations, the envelope system might be the best fit. This involves dividing your cash into separate envelopes allocated to different expense categories. This tactile approach can aid in visualizing spending limits and preventing overspending.

Ultimately, the most effective budgeting method is the one you can consistently adhere to. Experiment with different approaches to discover which best suits your preferences and helps you achieve your financial goals. Consider your level of comfort with detailed tracking, your need for structure, and your visual learning style when making your choice.

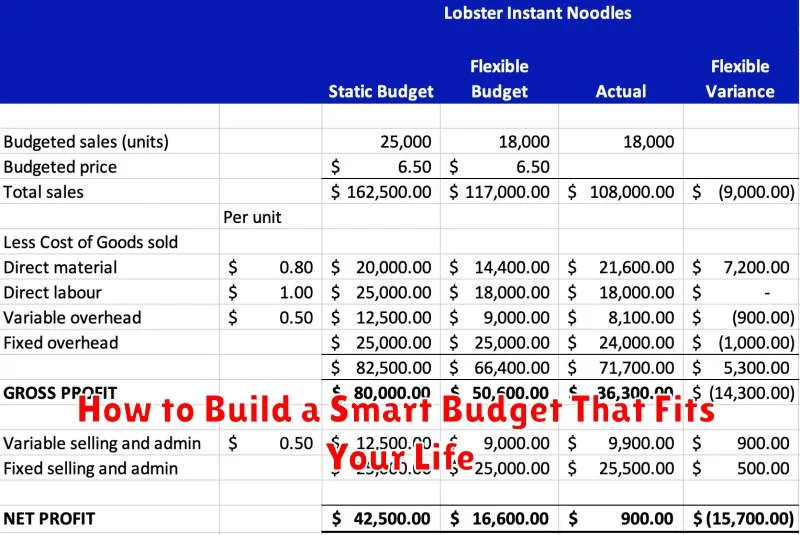

Categorize Expenses Based on Priorities

Building a smart budget requires more than just tracking your spending; it necessitates a strategic approach to categorizing your expenses based on their priority. This process allows you to identify areas where you can potentially cut back and allocate funds more effectively towards your financial goals.

Begin by dividing your expenses into essential and non-essential categories. Essential expenses are those necessary for survival and well-being, such as housing, food, utilities, transportation, and healthcare. These are typically fixed costs that are difficult to reduce significantly.

Non-essential expenses encompass everything else – things you’d like to have but can live without. This category includes entertainment, dining out, subscriptions, shopping, and hobbies. While seemingly less critical, careful management of these expenses can free up considerable funds for other priorities.

Within the non-essential category, further prioritize spending based on your personal values and goals. For example, if you prioritize travel, you might allocate a larger portion of your discretionary income to this area while cutting back on less important expenses. This personalized approach is key to ensuring your budget aligns with your lifestyle and aspirations.

Using a budgeting app or spreadsheet can greatly simplify the categorization process, providing a clear visual representation of your spending habits and helping you identify areas for improvement. Regularly reviewing and adjusting your categories based on changing circumstances will further optimize your budget’s effectiveness and help you achieve your long-term financial objectives.

Use Technology to Track and Alert Spending

Effectively managing your finances requires consistent monitoring of your spending habits. Technology offers powerful tools to simplify this process and provide valuable insights into your financial behavior. Numerous apps and software programs are available, each offering a range of features designed to help you track your spending.

Many budgeting apps automatically categorize transactions from linked bank accounts and credit cards. This automated tracking eliminates the manual entry of expenses, saving you significant time and effort. The visual representations, often in the form of charts and graphs, offer a clear picture of where your money is going, making it easy to identify areas for potential savings.

Beyond basic tracking, these apps often include features such as setting budget alerts. You can customize alerts to notify you when you’re nearing or exceeding your pre-set spending limits in specific categories. This proactive approach helps prevent overspending and keeps your finances on track. Some advanced platforms even provide personalized financial advice based on your spending patterns and financial goals.

The ability to visualize your spending is a key benefit of using technology. Seeing your expenses charted and categorized allows for better understanding of your financial habits. This clarity empowers you to make informed decisions and adjust your budget accordingly. The insights gained contribute significantly to building a smart budget that aligns perfectly with your lifestyle and financial aspirations.

Include Fun Money to Avoid Burnout

A smart budget isn’t just about tracking expenses and saving; it’s also about maintaining your well-being. Many budgeting methods focus solely on necessities, inadvertently neglecting a crucial element: fun money. Allocating a specific amount for leisure activities is essential to prevent burnout and maintain a healthy financial outlook.

Burnout stems from consistent stress and lack of self-care. When your budget feels restrictive and doesn’t account for enjoyable activities, it can contribute significantly to feelings of deprivation and overwhelm. Including fun money acts as a buffer, allowing you to engage in activities that relieve stress and boost your mood.

The amount allocated for fun money should be realistic and tailored to your individual circumstances. It could be a small weekly amount for a coffee with a friend, a monthly contribution towards a hobby, or even a quarterly allowance for a weekend getaway. The key is to make it a consistent part of your budget, thereby avoiding the temptation to dip into funds earmarked for other priorities.

Consider tracking your fun money spending. This isn’t about strict limitations, but about mindful spending. Understanding where your fun money goes can help you make adjustments and ensure you’re maximizing enjoyment from your allocated funds. This conscious approach prevents frivolous spending and ensures your leisure activities truly contribute to your well-being.

Integrating fun money into your budget is a strategic investment in your mental and emotional health. By acknowledging the importance of leisure and self-care, you create a more sustainable and fulfilling financial plan. It’s a crucial aspect of building a smart budget that works for you, not against you.

Adjust Monthly Based on Real Life Changes

Life is dynamic, and your budget should reflect that. Unexpected expenses and changes in income are inevitable. Building a truly smart budget means acknowledging this fluidity and incorporating a mechanism for regular adjustments.

Consider setting aside a contingency fund to absorb unforeseen costs, like car repairs or medical bills. This prevents these expenses from derailing your entire budget. Regularly reviewing your spending patterns, perhaps monthly or quarterly, is crucial. Track where your money actually goes; this provides valuable insight into areas where you might need to make adjustments.

Significant life changes, such as a job promotion, a move, or a change in family size, require more substantial budget revisions. A pay raise should be allocated strategically, perhaps increasing savings contributions or addressing long-term financial goals. Conversely, a job loss calls for immediate action, necessitating careful examination of expenses to prioritize essential costs and explore potential cost-cutting measures.

Flexibility is key. Your budget shouldn’t be a rigid, unchangeable document. Instead, it should be a living document that adapts to your ever-changing circumstances. Regularly reviewing and adjusting your budget ensures it remains a useful tool for managing your finances effectively, promoting financial health, and reducing financial stress.

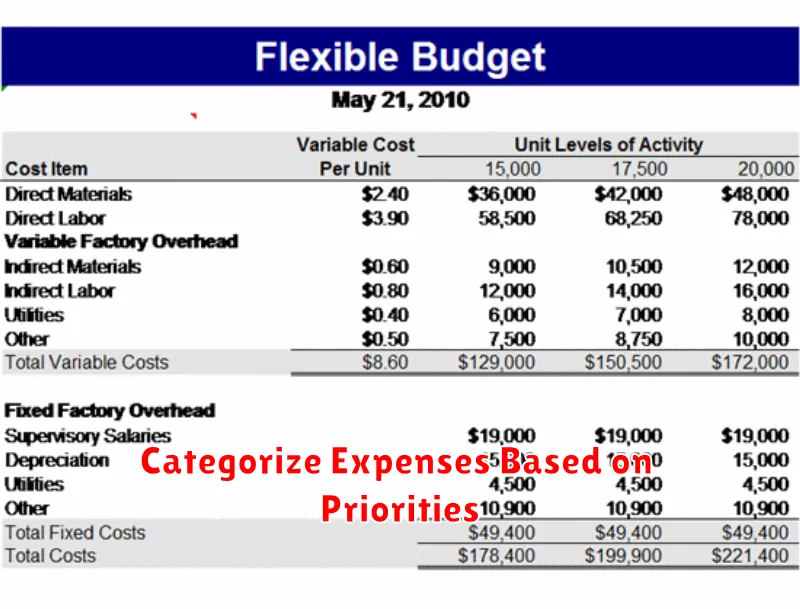

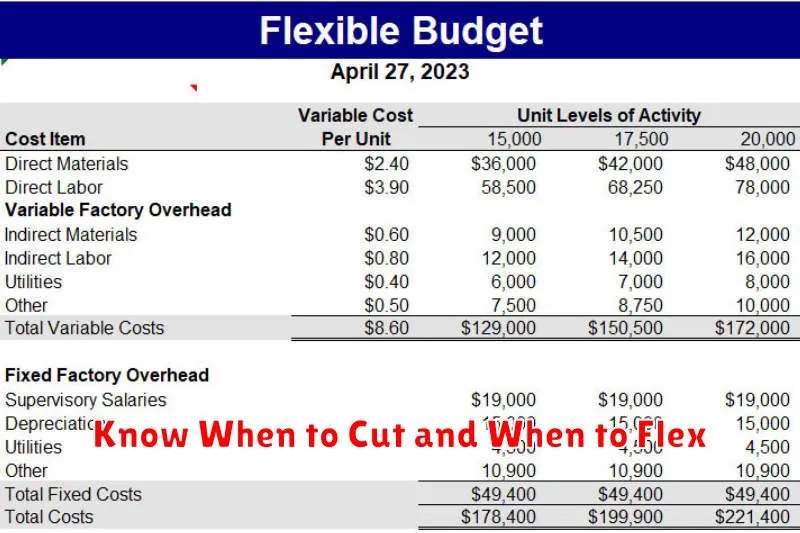

Know When to Cut and When to Flex

Budgeting isn’t about deprivation; it’s about conscious spending. A successful budget balances necessary cuts with areas where you can afford to be more flexible.

Cutting expenses requires identifying non-essential spending habits. This often involves scrutinizing recurring subscriptions, dining out, and entertainment costs. Ask yourself: Is this purchase truly adding value to my life? If the answer is no, it’s a prime candidate for reduction or elimination. Consider using budgeting apps to track your spending and identify areas where you can easily cut back.

Conversely, flexibility in your budget is crucial for maintaining morale and preventing burnout. Rigid budgets can feel restrictive and lead to unsustainable habits. Identify areas where you’re willing to spend a little more, whether it’s a monthly massage, a weekend getaway, or contributing to a hobby. These “flex” areas provide a sense of balance and can prevent you from feeling deprived. The key is to be intentional about it. Allocate a specific amount to these flexible spending categories, so they don’t derail your financial goals.

The art of smart budgeting lies in striking the right balance between these two approaches. Regularly review your spending habits and adjust your budget accordingly. What was a necessary expense last month might be expendable this month, and vice versa. By consciously choosing where to cut and where to flex, you create a budget that supports your financial well-being and your overall happiness.

Keep the Process Simple and Repeatable

Creating a smart budget doesn’t require complicated spreadsheets or financial software. The key is to establish a simple, repeatable process that you can maintain over time. A complex system is more likely to be abandoned, rendering your budgeting efforts ineffective.

Begin by choosing a method that suits your personal preferences and technological capabilities. Some people prefer pen and paper, while others thrive with budgeting apps. Regardless of your chosen method, ensure that your system allows for easy tracking of income and expenses.

A simple process might involve categorizing your spending into essential needs (housing, food, transportation), wants (entertainment, dining out), and savings. Regularly reviewing these categories allows you to identify areas where you can make adjustments and improve your financial health. Consistency is key; aim for a regular review, perhaps weekly or monthly, to stay on track.

Automation can significantly simplify the process. Set up automatic transfers to your savings accounts and explore bill pay options to reduce manual effort. This removes the potential for human error and ensures that your savings and bill payments remain consistent.

Remember, simplicity and repeatability are paramount. A sustainable budget is one that is easy to understand, implement, and maintain. Don’t overcomplicate things; focus on building a habit that will serve you well in the long run.