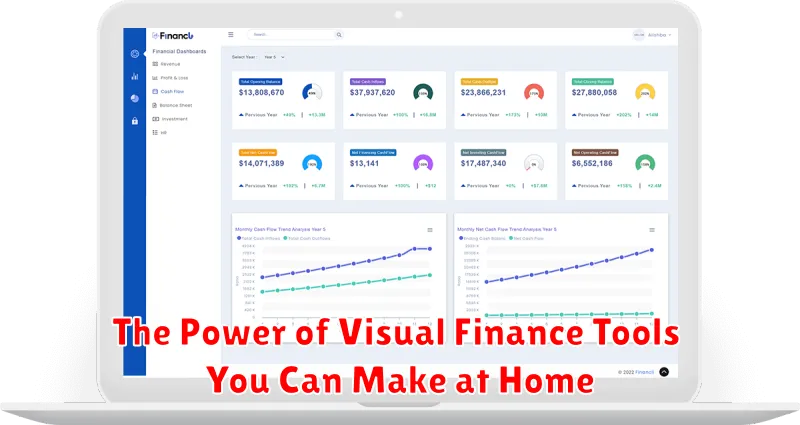

Harness the power of visual finance with tools you can create at home! This article explores how DIY visual finance tools can revolutionize your personal financial management. Learn to build effective budgeting charts, interactive debt trackers, and investment portfolio visualizers, all without needing specialized software or expensive subscriptions. Discover the transformative impact of visual data representation on your understanding and control of your finances.

Gain a deeper understanding of your financial health by transforming complex data into easily digestible visuals. We’ll guide you through simple, yet effective methods to create personalized financial dashboards and visual budgeting spreadsheets that cater to your specific needs. Unlock the potential of visual finance and take control of your money with practical, actionable steps you can implement today. Transform your approach to personal finance with the power of visualization.

Why Visual Tools Boost Motivation

Visual tools significantly enhance motivation by providing a tangible representation of progress and goals. Unlike abstract numbers or lengthy spreadsheets, visuals offer a quick and easily digestible summary of financial health. This immediate feedback loop is crucial for maintaining momentum and staying focused on long-term financial objectives.

The human brain is naturally drawn to visual information; we process images much faster than text. Therefore, charts and graphs displaying budget allocations, debt reduction, or investment growth instantly communicate complex financial data in an accessible and motivating way. Seeing progress visually can spark a sense of accomplishment and encourage continued effort.

Furthermore, the ability to customize visual tools caters to individual preferences and learning styles. A personalized chart or graph becomes a powerful motivational tool, intrinsically linking personal satisfaction with financial success. This personalized approach fosters a sense of ownership and control, leading to greater engagement and a higher likelihood of achieving financial goals.

Visual aids also help to identify areas needing improvement more clearly. A poorly performing investment, for example, is easier to spot on a chart than in a dense financial statement. This clarity facilitates better decision-making and allows for timely adjustments to strategies, boosting motivation by demonstrating the direct impact of proactive steps.

In short, the psychological impact of seeing visual representations of financial progress should not be underestimated. By making financial data more accessible and engaging, visual tools foster a stronger sense of control, accomplishment, and ultimately, motivation.

How to Make a Savings Thermometer

A savings thermometer is a simple yet effective visual tool to track your progress towards a financial goal. It leverages the power of visual representation to boost motivation and keep you engaged in your savings journey. Creating one at home is a fun and rewarding project for the whole family.

To begin, you’ll need a few materials: a large piece of sturdy paper or cardboard, markers or paints, a ruler, and scissors. You can also add decorative elements such as stickers, glitter, or washi tape to personalize your thermometer.

First, design your thermometer. Draw a large thermometer shape on your paper, ensuring that it’s big enough to clearly show your savings progress. Clearly mark the bottom with “0” and the top with your target savings amount. You can divide the thermometer into smaller increments, such as percentages or smaller monetary amounts, for easier tracking.

Next, color and decorate your thermometer. Get creative! Use bright colors to make it visually appealing. You might even want to theme it around your savings goal – for example, if you’re saving for a vacation, you could decorate it with beach scenes.

Finally, find a prominent place to display your thermometer. Hang it on the refrigerator, a wall, or any other easily visible area in your home. As you make deposits towards your savings goal, color in the thermometer to reflect your progress. This visual representation will serve as a constant reminder of your goal and will help to keep you motivated.

Remember, the key is to make it personal and motivating. The more visually engaging your thermometer is, the more likely you are to stay committed to your savings plan.

Use Sticky Notes to Track Bill Payments

Sticky notes offer a surprisingly effective method for managing bill payments, especially for those who prefer a visual and tactile approach to personal finance. Their simplicity allows for easy implementation and customization.

One popular method involves using a large calendar or whiteboard. Assign a different colored sticky note to each recurring bill (e.g., blue for rent, yellow for utilities, pink for credit cards). Write the due date and amount on each note. Then, place the sticky notes on the calendar corresponding to their due dates. This provides a clear, at-a-glance view of upcoming payments.

Another effective technique is to use a separate sticky note for each bill payment. Keep these notes on a designated area like a fridge or a notice board. Once a bill is paid, remove the corresponding note. This simple act of physically removing the note provides a satisfying sense of accomplishment and visual confirmation of completed tasks. The remaining notes serve as a clear reminder of upcoming bills.

For those managing multiple accounts or numerous bills, consider using a color-coding system to categorize bills further by account or type of expense (e.g., different shades of blue for various credit cards, or green for subscriptions). This added layer of organization helps prioritize payments and visually differentiate between different types of expenses.

The flexibility of sticky notes allows for easy adjustments. If a due date changes, simply move the note. Adding notes for upcoming payments is also straightforward. The system adapts readily to your changing financial needs and offers a hands-on approach to managing your finances.

Create a Financial Vision Board

A financial vision board is a powerful visual tool to help you clarify and manifest your financial goals. It’s a personalized collage of images, words, and affirmations representing your desired financial future. Creating one can be a surprisingly effective way to boost your motivation and stay focused on your objectives.

To begin, gather your materials: large poster board, magazines, scissors, glue, pens, and any other decorative items you wish to include. Consider incorporating elements that represent your aspirations, such as images of a dream home, a luxury car, a comfortable retirement, or even symbols of financial freedom like a flourishing plant or a flowing river representing abundance.

Next, brainstorm specific financial goals. Be as detailed as possible. Instead of simply writing “pay off debt,” specify the amount and the timeframe. Instead of “buy a house,” list the desired location, style, and features. This level of detail will help you create a more impactful vision board.

Start cutting out images and words that resonate with your goals. You can include pictures representing your desired income level, investments, savings goals, or even financial milestones you hope to achieve. Don’t be afraid to get creative and personalize it with your own unique style.

Once you have a collection of images and words, arrange them on your poster board. Experiment with different layouts until you achieve a visually appealing and motivating composition. Remember, this is your personal vision board, so make it reflect your unique style and aspirations. Once you are satisfied with the arrangement, glue the pieces in place.

Finally, add any personal touches. You might write affirmations or inspirational quotes related to your financial goals. Consider including a timeline or specific dates to help you stay accountable. Display your completed vision board in a prominent location where you’ll see it daily, serving as a constant reminder of your financial aspirations.

Draw Your Debt Snowball Roadmap

Visualizing your debt repayment plan can significantly boost your motivation and clarity. A debt snowball roadmap, a simple yet effective visual tool, helps you track your progress and stay focused on your financial goals. It leverages the psychological power of seeing your debts shrink, fueling your determination to pay them off.

To create your roadmap, begin by listing all your debts. Include the creditor, the current balance, and the minimum monthly payment for each. Order your debts from smallest to largest balance, regardless of interest rate – this is the core principle of the debt snowball method.

Next, choose your preferred visual format. You could use a large sheet of paper, a whiteboard, or even a spreadsheet program. For each debt, create a visual representation of the balance. This could be a simple bar graph, where the bar length represents the outstanding balance. As you make payments, you can visually reduce the length of the bar, providing a satisfying representation of your progress.

Regularly update your roadmap. This reinforces your commitment and allows you to celebrate milestones as you pay off smaller debts. The feeling of accomplishment from crossing off smaller debts provides the momentum to tackle larger ones, further enhancing your financial discipline.

Consider adding color-coding to your roadmap. Assign different colors to different types of debt (e.g., credit cards, student loans). This can improve the visual appeal and make it easier to identify the source of each debt.

Remember, the key to a successful debt snowball roadmap is consistency. Regularly review and update your chart to stay motivated and track your progress toward becoming debt-free.

Make It Visible Where You Spend the Most

One of the most effective ways to improve your financial health is to visualize your spending habits. Many people find it challenging to track expenses accurately, leading to a hazy understanding of their financial situation. By making your spending visible, you gain a clearer picture of where your money is going.

Consider creating a visual representation of your spending in a prominent location. This could be a whiteboard in your kitchen, a corkboard in your home office, or even a large sheet of paper affixed to your refrigerator. The key is choosing a space where you’ll see it daily, serving as a constant reminder of your financial activity.

Categorize your spending into key areas, such as housing, transportation, groceries, entertainment, and debt payments. You can use different colored sticky notes or markers to represent each category, making it easy to identify areas where you’re spending the most money. This simple visual aid will quickly highlight areas ripe for potential budget adjustments.

The act of physically writing down or visually representing your spending acts as a powerful accountability tool. It makes your financial decisions more tangible and less abstract. This increased awareness can be a game-changer in curbing impulsive purchases and promoting more mindful spending habits.

Remember, the goal isn’t just to track your spending, but to understand it. By making your spending visible in a place you frequent, you’ll foster a greater sense of awareness and control over your finances, leading to more informed and responsible financial decisions.