Are you worried about falling into a debt trap? Do you find yourself constantly struggling to make ends meet, juggling multiple high-interest loans, or feeling overwhelmed by mounting financial obligations? This article will equip you with the knowledge and strategies to effectively recognize and avoid debt traps early on. We will explore practical steps to manage your finances, understand the warning signs of overspending, and develop a proactive approach to financial responsibility. Learning to identify and avoid these debt pitfalls is crucial for achieving long-term financial stability and securing your future.

Understanding the dynamics of debt is the first step toward escaping its snare. This guide will delve into common debt traps, such as payday loans, high-interest credit cards, and unsecured personal loans. We’ll provide actionable advice on creating a budget, improving your credit score, and negotiating with creditors to alleviate financial stress. By mastering the principles outlined here, you can take control of your finances, build a strong financial foundation, and avoid the crippling effects of unmanageable debt. Learn how to avoid debt and achieve financial freedom today!

Common Signs You’re Entering a Debt Cycle

One of the first warning signs is consistently spending more than you earn. This often manifests as relying on credit cards to cover essential expenses like groceries or utilities. If you find yourself regularly maxing out your credit cards or constantly juggling payments between different accounts, it’s a clear indication that you’re slipping into a debt cycle.

Another significant indicator is a growing reliance on high-interest debt, such as payday loans or cash advances. These loans often come with cripplingly high interest rates, trapping you in a cycle of debt where you’re perpetually paying off interest rather than the principal balance. The inability to make minimum payments on time is another significant red flag.

Difficulty saving money is another common sign. If you’re struggling to put any money aside for emergencies or future goals, it may be because the majority of your income is going towards debt repayment. This lack of savings makes you even more vulnerable to falling further into debt when unexpected expenses arise.

Experiencing constant financial stress and anxiety is also a key indicator. This stress isn’t just about the debt itself; it often stems from the constant worry about managing bills, making payments, and the overall uncertainty surrounding your financial situation. This anxiety can significantly impact your mental health and well-being.

Finally, a noticeable shift in your spending habits should raise a red flag. Are you buying less-essential items on credit, purchasing items you can’t afford, or using credit for convenience rather than necessity? These shifts can signify a growing reliance on credit and a potential slide into a debt cycle.

How Credit Card Minimums Mislead You

Credit card companies often present minimum payment amounts as a convenient way to manage your debt. However, these seemingly small payments can be incredibly misleading and ultimately lead you deeper into a debt trap.

The primary way minimum payments mislead you is by obscuring the true cost of borrowing. While paying the minimum keeps your account in good standing (for now), the vast majority of your payment goes towards interest, not the principal balance. This means you’re paying a significant amount each month, but barely making a dent in the actual amount you owe.

Consider this: Let’s say you have a balance of $1,000 with a 18% APR and a minimum payment of $25. Your statement may show a small payment, but a large portion of that $25 goes to interest. You’re extending the repayment period significantly and accumulating additional interest charges with each passing month. The interest charges compound over time, making it incredibly difficult to pay off the balance.

Furthermore, the minimum payment amount is not static; it often fluctuates based on your balance and can even increase in some cases. This can lead to a false sense of security as you pay off your balance, only to have that minimum payment increase again, and then have to pay more later to keep up. This makes it harder to create a reliable budget and to accurately plan your finances.

To avoid this trap, always aim to pay more than the minimum payment each month. Even an extra $20 or $30 can significantly reduce your interest payments and shorten your repayment period. Creating a budget that allows for larger credit card payments will ensure you avoid falling victim to the misleading nature of minimum payments and build better financial habits in the long run.

Avoiding the Buy Now Pay Later Temptation

Buy Now Pay Later (BNPL) schemes are aggressively marketed as a convenient way to finance purchases. However, their ease of use often masks significant financial risks. These services can quickly lead to debt accumulation if not managed carefully.

One of the biggest dangers of BNPL is the illusion of affordability. The small, seemingly manageable monthly payments can make larger purchases feel accessible, encouraging impulsive spending. This can lead to accumulating multiple BNPL loans without fully understanding the overall financial impact.

To avoid falling into this trap, it’s crucial to budget meticulously before considering any BNPL option. Calculate the total cost, including interest and fees, and compare it to the price of paying in full. If you can’t afford to pay the total amount within the repayment period, it’s best to avoid the purchase altogether or explore alternative financing with lower interest rates and more transparent terms.

Furthermore, track your BNPL spending diligently. Keep a record of all active loans, payment due dates, and interest charges. This will help prevent you from overlooking payments and accumulating late fees, which can rapidly increase your debt.

Before utilizing BNPL services, consider the long-term consequences. Will the purchase significantly improve your life or is it a frivolous expense? Prioritize essential purchases and postpone non-essential items until you can afford to pay for them outright. This will prevent you from falling into a cycle of debt.

Remember, the convenience of BNPL often comes at a cost. By carefully evaluating your financial situation, budgeting effectively, and practicing mindful spending, you can effectively avoid the tempting but potentially damaging allure of Buy Now Pay Later schemes.

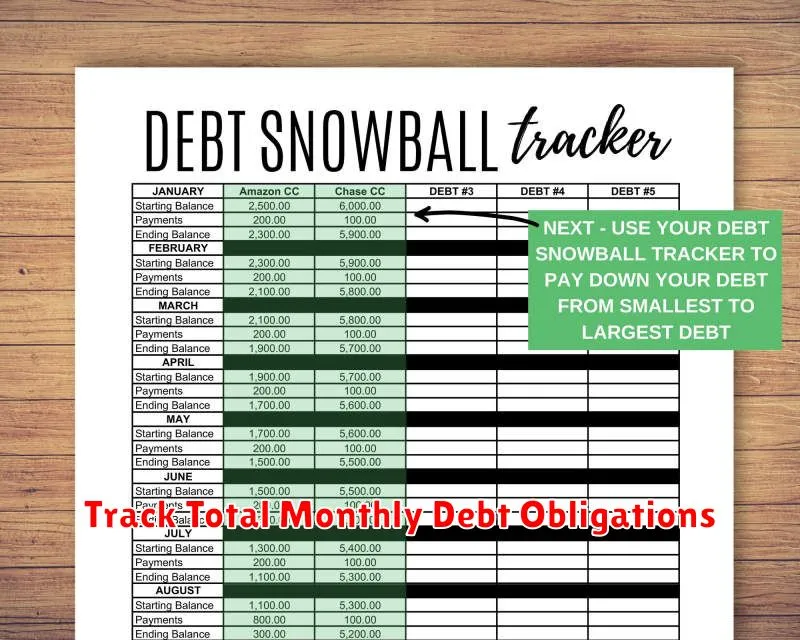

Track Total Monthly Debt Obligations

One of the most crucial steps in avoiding debt traps is diligently tracking your total monthly debt obligations. This involves compiling a comprehensive list of all your debts, including credit card balances, loans (personal, auto, student, etc.), and any other recurring debt payments.

For each debt, note the principal balance, the interest rate, and the minimum monthly payment. Accurately calculating the minimum payment for each debt is vital, as exceeding these minimums can significantly impact your overall financial health and lead to accumulating debt.

Once you have compiled this list, calculate the sum of all your minimum monthly payments. This total represents your total monthly debt obligations. This figure is a critical indicator of your overall financial health and your susceptibility to debt traps. Comparing this number against your monthly income will illuminate the proportion of your income dedicated to paying off debt.

Regularly updating this list is crucial; neglecting to do so can lead to an inaccurate picture of your financial status. Make it a habit to review and update your debt tracker at least once a month, preferably immediately after making your debt payments.

Utilizing a spreadsheet or a personal finance app can streamline this tracking process. Many apps and budgeting tools provide features for automatically importing account information and calculating debt obligations, ensuring accuracy and minimizing manual input.

By actively tracking your total monthly debt obligations, you gain valuable insight into your spending habits and your ability to manage debt. This awareness empowers you to make informed decisions, adjust spending accordingly, and prevent yourself from falling into a debt trap.

Use Simple Ratios to Assess Risk

Understanding your financial health requires more than just looking at your bank balance. Debt-to-income ratio (DTI) is a crucial metric. This ratio compares your total monthly debt payments (including mortgages, loans, and credit card minimums) to your gross monthly income. A healthy DTI is generally considered to be below 36%, with lower being better. A higher DTI indicates a greater risk of falling into a debt trap.

Another important ratio is your debt-to-asset ratio. This compares the total value of your debts to the total value of your assets (things you own, like a house, car, or investments). A low debt-to-asset ratio signifies strong financial health, while a high ratio suggests vulnerability. Ideally, you want your assets to significantly outweigh your liabilities.

The savings-to-income ratio offers a different perspective. This ratio shows the percentage of your income that you are saving each month. A robust savings-to-income ratio is a buffer against unexpected expenses and financial emergencies, reducing your reliance on debt. Aim for a savings rate that enables you to build an emergency fund and contribute to long-term savings goals.

Calculating these simple ratios can provide a clear picture of your current financial standing. By regularly monitoring these key indicators, you can proactively identify potential risks and make informed decisions to avoid spiraling into unmanageable debt.

Create a Plan to Exit Debt Gradually

Falling into debt can feel overwhelming, but a structured approach can help you regain control. The key is to create a realistic plan to pay off your debts gradually. This plan should account for your income, expenses, and the types of debt you owe.

Begin by listing all your debts, including the principal amount, interest rate, and minimum payment for each. Categorize them – credit cards, student loans, personal loans, etc. – as different debt types often have different interest rates and repayment terms.

Consider using debt repayment strategies like the snowball method or the avalanche method. The snowball method focuses on paying off the smallest debt first, regardless of interest rate, for motivational purposes. The avalanche method prioritizes paying off debts with the highest interest rates first, saving you money on interest in the long run. Choose the method that best suits your personality and financial situation.

Once you’ve selected a strategy, build a detailed budget. Track all your income and expenses meticulously. Identify areas where you can reduce spending to free up more money for debt repayment. Even small reductions in discretionary spending can make a significant difference over time.

Regularly monitor your progress and make adjustments as needed. Life throws curveballs; unexpected expenses can derail your plans. Be prepared to adapt your budget and repayment strategy accordingly. Celebrating small victories along the way can help maintain momentum and prevent discouragement.

Finally, seek professional financial advice if you’re struggling to manage your debt. A financial advisor can help you create a personalized debt management plan and navigate complex financial situations. Remember, a gradual approach is key – consistent effort is more valuable than drastic, unsustainable measures.